what is tax planning explain its characteristics and importance

A major goal of tax planning is minimizing federal. It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act.

Perseverance Essay For All Class Students Essay Perseverance Student

It involves evaluating the businesss current financial situation estimating probable profit or loss for the next quarter.

. Tax Planning - Importance and Benefits of Tax Planning. Tax planning is an integral activity conducted by every person earning through salary professional or other activities and organizations in India. Many people use the term tax planning but it is often misunderstood.

Tax planning is crucial for budgetary. Discuss the objectives importance and types of tax planning. Tax planning is commonly defined as the manner of forecasting your tax liability and creating circumstances and ways to reduce it.

It is the art of learning how to manage your affairs in ways that postpone. A tax is a leakage from the circular flow of income into the public sector. Importance Significance of Planning.

In other words you want to reduce what you owe on your tax bills by taking advantage of any allowances exclusions exemptions. How to work in the future includes planning. Objectives of Tax Planning Tax planning in fact is an honest and rightful approach to the attainment of.

In modern economies taxes are the most important source of governmental revenue. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances. Tax planning refers to the process of minimising tax liabilities.

By stating in advance how work has to. It helps managers to improve future performance by establishing objectives and selecting a course of action for the benefit of the organisation. However taxation is not a governments only source of revenue.

The Importance of Tax Planning. It is paid by individuals corporations and other associations of individuals. Tax planning is the logical analysis of a financial position from a tax perspective.

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Tax Planning allows a taxpayer to make the best use. Tax planning involves the analysis of your financial.

Tax planning is a focal part of financial planning. Tax planning considers the implications of individual investment or business decisions usually with the goal of minimizing tax liability. Tax planning can have some great benefits for any business large or small.

Tax planning means you and your tax planning advisor take an in-depth look at where you are most liable for taxes. Importance of Planning. Tax planning lets you decide how to approach each.

It represents a payment out of the income. Planning Provides Direction-Planning provides us with direction.

Pin By Markus Miklas On My Saves What Is Work Blog Legal Canyon Country

Sales Plan 101 Definition Types And Template

Income Tax Multiple Choice Questions Mcq With Answers Updated In 2021 Income Tax Income Tax Day

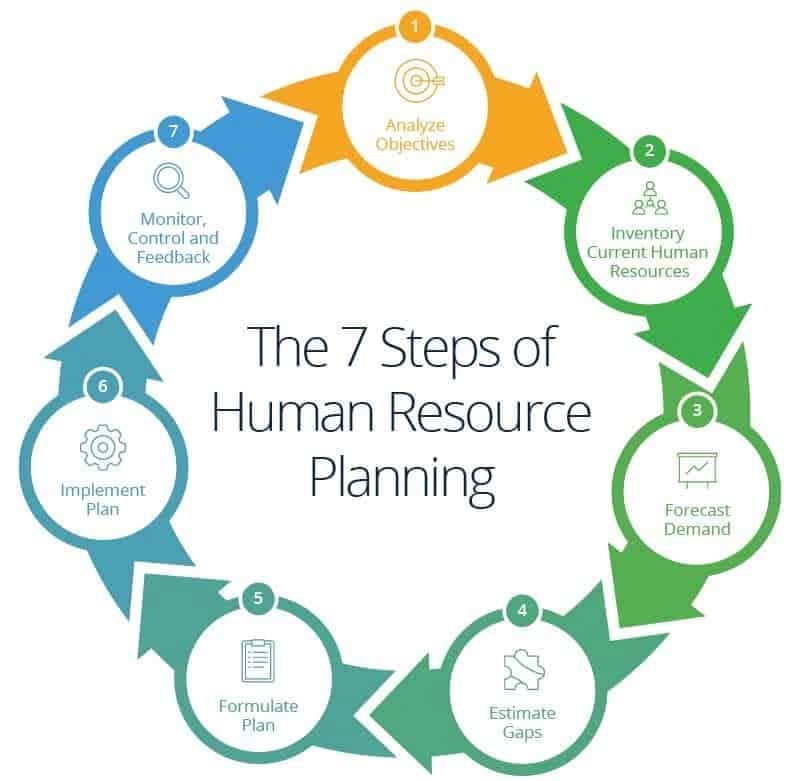

Why Is Human Resource Planning Important Itchronicles

Difference Between Internal Audit Internal Control Audit Services

Definition Of Joint Stock Company Lesson Company Definition Learning

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

How To Invest Money 13 Proven Investment Tips You Must Know Investment Tips Investing Investing Money

What Is Tax Planning Definition Objectives And Types Business Jargons

Financial Planning Meaning Definition Types Principle Advantages And Disadvantages Of Financial Planning Financial Planning Financial Meant To Be

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

15 Advantages Of Computerized Accounting System Computerized Accounting Accounting Accounting And Finance

Why Is Human Resource Planning Important Itchronicles

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy